In recent months, the seaborne trading map between Asia and Europe has undergone a significant transformation due to the Houthis' intervention in the Gaza conflict. This geopolitical shift is not only reshaping global trade dynamics but is also contributing to a concerning rise in shipping's carbon footprint, with a recent report suggesting a potential more than five-fold increase in CO2 emissions per container shipped.

Approximately 12% of global trade, valued at over $1 trillion (£790 billion), traverses the Red Sea annually. However, numerous shipping firms are opting to circumvent this region altogether, choosing a lengthy detour around the African continent instead of navigating the Red Sea and the Suez Canal.

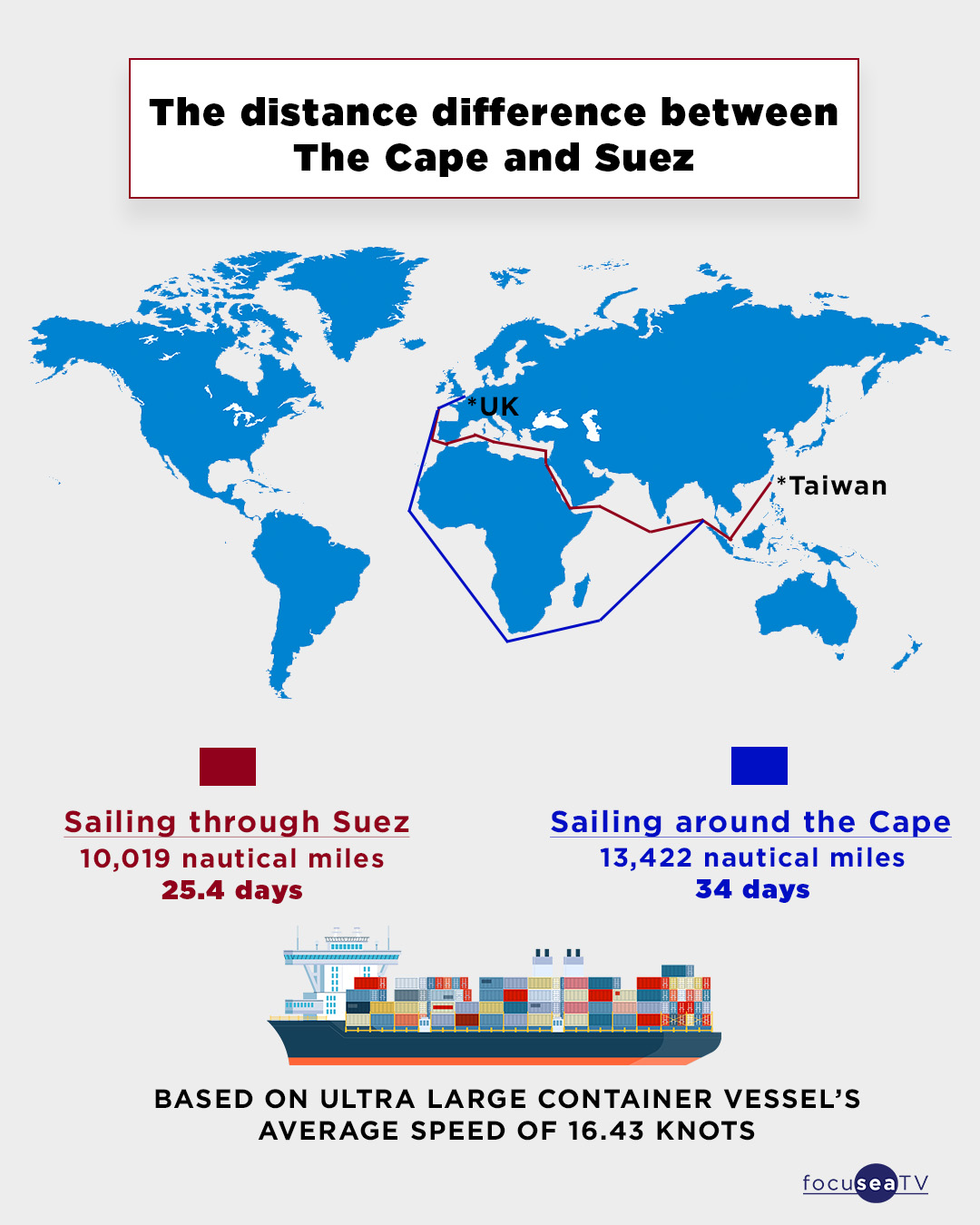

The logistics involved in rerouting these massive container ships, some exceeding 300 meters (984 feet) in length, are considerable and time-consuming.

Amid the escalating risks in the Red Sea, where the Houthis have targeted around 35 merchant ships since November and hijacked one car carrier, vessels of all types and sizes are increasingly opting for the safer route via the Cape of Good Hope.

The latest data from Clarksons Research reveals a drastic decline in Gulf of Aden ship arrivals, with a 65% reduction compared to 2023 levels. Recorded arrivals of container ships have plunged by 90%, tankers by 45%, gas carriers by 90%, and bulkers by around 30%.

Traditionally, boxships take 31 days to cover the 10,000 nautical miles between Shenzhen and Rotterdam via the Suez Canal. Opting for the southern African route via the Cape of Good Hope extends the journey to more than 13,000 nautical miles, requiring at least 41 days.

In terms of CO2 emissions, a recent study by Danish consultancy Sea-Intelligence highlights the additional pollution per TEU (twenty-foot equivalent unit) due to longer sailing distances, increased speeds, and the potential deployment of smaller ships on the alternative southern African route.

The study suggests a potential rise in CO2 emissions per TEU ranging from 31% to 575%.

These longer journeys are impacting a ship's Carbon Intensity Indicator (CII) and the newly introduced European Union Emission Trading Scheme (EU ETS).

Notably, Clarksons Research has examined the broader changes in tonne-mile demand for 2024 resulting from the Red Sea shipping crisis. For instance, the Russian invasion of Ukraine and the subsequent EU ban on Russian oil products have led to a 5.5% increase in product tanker tonne-mile demand.

Estimates from Clarksons suggest that containerships and car carriers are experiencing the most significant increases in tonne-mile demand due to rerouting via the Cape of Good Hope within the shipping sector. However, these shifts also raise concerns about increased fuel consumption and emissions, potentially jeopardizing industry efforts to reach emission reduction targets set by the International Maritime Organization.